Monero’s Flaws Make it More Valuable

We analyze Monero’s vulnerabilities to deprive our enemies of criticism and then weaponize their ideas against them.

Premise

In the movie 8 mile, the rapper Eminem attacks himself first to leave his enemy speechless after. We replicate this strategy by openly pointing out Monero’s vulnerabilities to deprive our enemies of criticism and then weaponize their ideas against them.

You would get a lot out of subscribing for free to our new content by email, by Session messenger, via RSS feed, or on Nostr.

Criticism #1:

Monero’s delistings hurt adoption

Response:

It’s true that Monero gets delisted from centralized KYC exchanges that come under pressure from corrupt governments acting against their own constitutions. However, the fact that Monero isn’t listed on these speculative exchanges, makes it less volatile to fake news and whipsaw price action, and therefore this price stability makes it actually useful as a currency and medium of exchange. Since these centralized exchanges usually offer high leverage and quick access, it doesn’t make sense for daytraders to trigger sell Monero when bullshit headlines fill Bloomberg trading screens. Bitcoin’s motto is “Hodl”, while Monero’s model is “do you accept it?”

Criticism #2:

Monero could be banned, so it’s risky

Response:

Because Monero is designed to resist a ban, owning it is a form of a synthetic put option on the industry as a whole. Therefore we argue that adding Monero to a large crypto portfolio REDUCES risk because if all of crypto rises, then XMR will rise with it. But if all cryptocurrency is banned, you can bet Monero will either rise or fall the least.

Short Sales

Additionally, Monero is one of the most shorted cryptocurrencies on centralized exchanges as speculators think further delistings or a direct ban will hurt it. For example Gate.io publicly publishes their derivatives statistics and Monero has averaged above 60% short for years. But if XMR stopped trading on centralized exchanges, this would be a synthetic short squeeze because the short sellers have to buy it to comply with the ban.

Derivatives

If haters reply that its being shorted primarily through derivatives and that the exchange can just close these “fake positions” without the shorts having to buy, then they have just admitted that Monero’s interest rate is being artificially suppressed. Because the only way positions can be closed directly is if borrowers are getting a free short sell with no connection to real supply. After a direct ban, all of the short selling demand would completely vanish. But if the previously leveraged “high conviction” buyers wanted to recreate their positions in the spot or DeFi markets, they’d now have to do so without the previous artificial interest rate suppression.

Peer-to-Peer

Monero has the most vibrant peer-to-peer markets. If Monero is banned, recent technology developments with two-way atomic swaps will allow it to continue globally regardless. The Particl team has developed bi-directional atomic swaps, Elizabeth Binks has developed ETH-XMR atomic swaps, and DarkFi has a unique and completely private method as well.

Mixers

Finally, Monero is MORE compliant than Bitcoin mixers, because those mixers are acting as a separate financial agent from the currency itself which adds KYC requirements. And unlike Tornado Cash, there is no centralized actor getting proceeds to sanction.

Criticism #3:

Large institutions will never adopt Monero because of it’s dark web stigma.

Response:

Monero is the most friendly to whales. Hedge funds judge altcoin technology by its value proposition and Monero’s is real strong with fund managers, because with Bitcoin, Ethereum, or other transparent blockchains, a large whale bringing their assets on to the exchange to sell creates a panic. Quick algorithmic trading bots run to short sell or front-run orders using blockchain analysis. Because of this, Monero is the most friendly asset for very large players looking to move in silence.

Criticism #4:

Monero aids crime, so we should ban it

Response:

Criminals will use the best tools regardless of the law and a ban would only deprive compliant citizens of their civil liberties. On the other hand, transparent blockchains create crime because every time you pay for something, thugs will see the value in your wallet. The world is not even ready for the amount of robberies and phising scams that will happen in the future with a transparent blockchain world.

Phising

Even now, Monero isn’t vulnerable to $0 fake output phising attacks that plague other coins. Other coins such as Ethereum and Tron, suffer hundreds of millions of dollars a year in losses from fake $0 output attacks. With these mentioned coins, anyone can SEND a $0 outgoing transaction FROM your wallet, with the goal of having you copy and paste the wrong address by using similar outgoing addresses. Monero completely prevents this kind of attack by disguising your activity.

Criticism #5:

Monero’s flaw is end-to-end attacks, which means that the same person/group is on both sides of trades.

For example, Bob sells you Monero, then the person you give it to sells it to Bob:

Bob → You → Bob’s exchange

You can think of this poison output attack as a SIMILAR CONCEPT to when undercover cops mark a hundred dollar bill or write down its serial number to see what bank this drug money is deposited to.

Response:

This flaw is not a hypothetical dream, but a realistic situation, as in the United States, Kraken is the only KYC exchange to trade Monero. In open discussion of this academically to support whistleblowers and constitutional human rights, the way around this end-to-end attack is clearly to buy Monero on a peer to peer exchange and NOT on Kraken. Because Monero sells for MORE on peer to peer markets than it’s KYC exchange value, and considering that there is essentially 0 risk from doing this if you received the Monero directly from a customer for goods or services, the author of this article argues that privacy is a fundamental human need and therefore Monero is worth MORE because of its flaws.

Final

If you found this of value, please consider a micro XMR donation of like 25 cents or so.

This goes to pay for video animation and web hosting. XMR address:

89gbof7fHub9dSMGVX2mGhDggU8TWXuFtGxbKefVNCpWCa377BS8uPzRr831Qd86FWRvPDTrvjkbHYZHgs5nmohRL5j1KiH

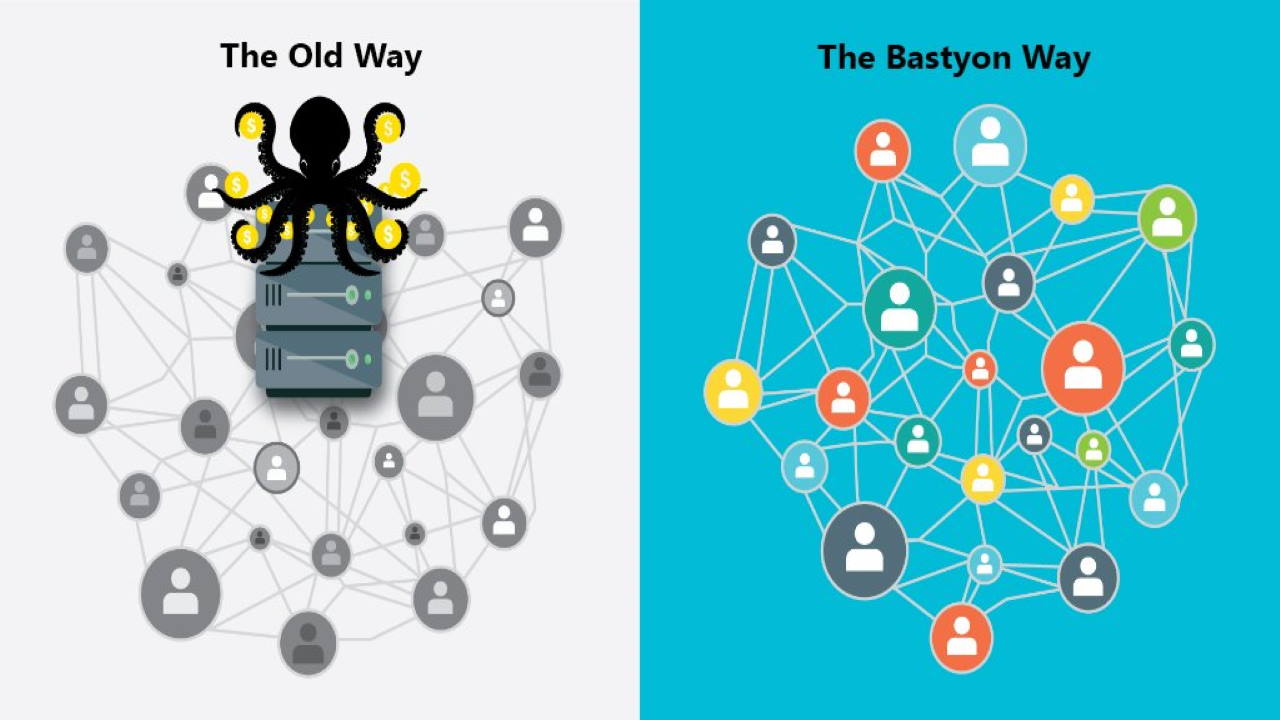

If you really want to learn and take your privacy to the next level, subscribe to our new content via: Nostr, Bastyon, Session, RSS, Ethereum Push

Related Posts

Tips to Avoid Getting Flagged with P2P Monero

Legally avoid problems with your financial institutions

[SP]

Oct 13, 2024

Bitcoin's transparency hurts its use

When you spend Bitcoin, it creates tiny capital gains

[anon-bobo]

Oct 12, 2024

Make money off the Telegram founder being jailed?

Bastyon is the Russian Nostr, and it's rising in popularity. Even if just 1 or 2% of Telegram's userbase moves over to posting on Bastyon, the coin would have to dramatically increase

[SP]

Aug 27, 2024

Haveno: No KYC Monero

Haveno is a peer-to-peer marketplace to buy Monero without official KYC processes.

Aug 16, 2024